Forecasting is effectively trying to predict the future, making it one of the most daunting tasks for business owners and their advisors. But it’s also one of the most important.

There are two broad categories when it comes to your cash: budgets and forecasts.

Budgets set targets or intentions for business activity and should be developed with input from those who are responsible for these activities (e.g. sales team should have input into sales targets; procurement staff into purchasing budgets).

While it’s ultimately the business owner or manager’s decision how much money is spent where, getting buy-in from the teams who will put those budgets to use is critical to their success.

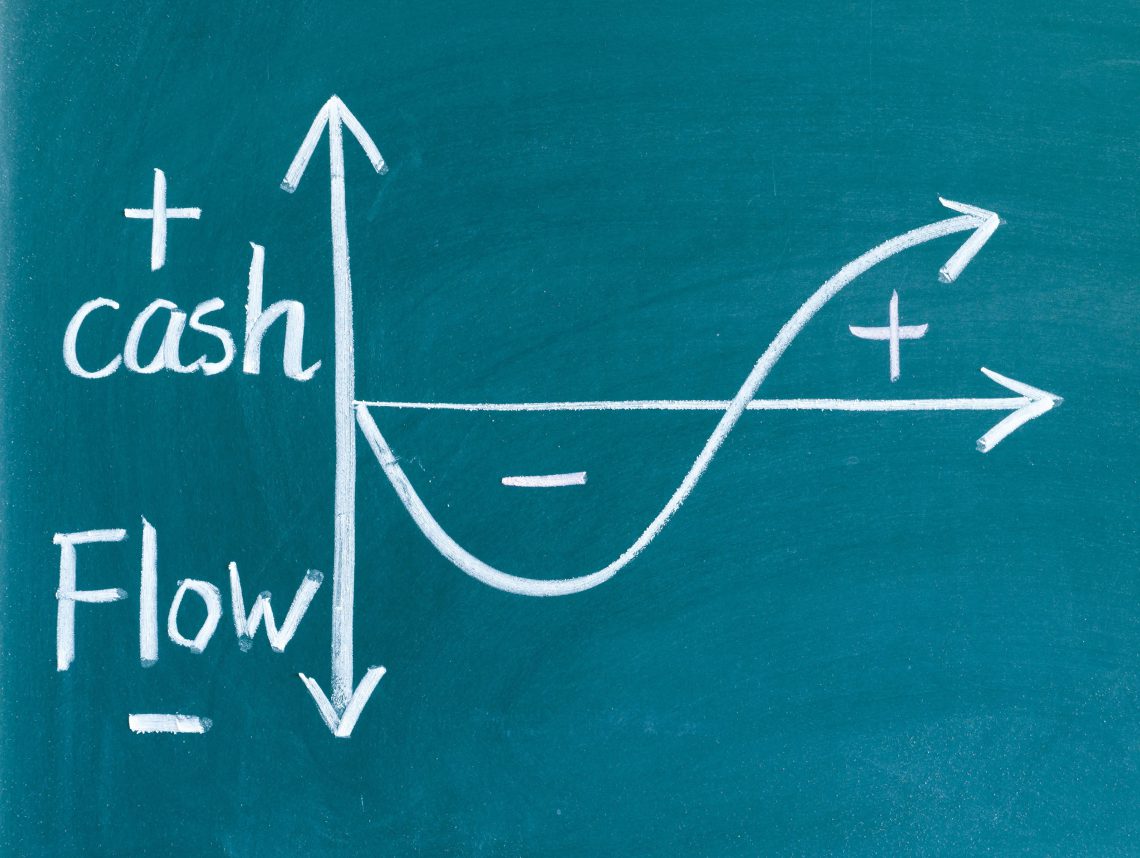

Along with budgets, you have forecasts setting out future expectations based on what we already know and can anticipate. The most valuable forecasts are cash flow reports, which should be living, breathing documents; cash flow can always change.

After people, cash is the most important asset of any business. Let’s take a look at some of the most helpful cash flow report types you can create for your clients.

Short-term cash flow forecasts

A short-term forecast is simply a case of mapping out future movements of your bank account, usually on a daily basis. It’s done on up to a 12-month period, and ideally on a rolling basis.

This is one of the most important business tools, but one too many businesses only look to it in times of panic — and often too late.

Start with a plan of your known outflows: people costs and regular outgoings, for example. These are the overheads your cash inflows need to cover.

Don’t fall for the trap of taking profit and loss (P&L) items and assuming they have the same behaviour in cash flow terms.

For example, gross payroll expense in the P&L is broken into net payroll and tax for cash flow purposes, each with individual behaviours that must be forecast correctly.

Don’t forget about those long-term flows out of the business, like investments/asset purchases, loans and equity. These are not P&L items.

Next, look at inflows. This is all about the timing of revenue receipts. Think about any variable cash flows associated with sales, such as delivery costs, the frequency at which they occur.

Again, don’t forget about those long-term flows into the business, like investments/asset sales, loans and equity as mentioned above

3-way forecasts: P&L, balance sheet, and cash flow

3-way forecasting is generally used for funding applications or as proof for formal debt agreements or activities. It’s a technical exercise, so the right expertise is needed here.

In developing the short-term cash flow forecast, you’ll have worked with P&L items, so a lot of your work here is already done!

Be careful of items that go in cash flow and not in P&L (e.g. most long-term items such as asset purchases and sales, loan and equity transactions) and vice versa (e.g. depreciation).

The balance sheet pieces everything together, looking at movements in the bank account (cash flow forecast) and equity (P&L), via movements in other balance sheet accounts (debtors and creditors for example).

Scenario comparisons

Rarely do things go according to plan. That’s why it’s wise to forecast for varying, realistic scenarios — aka ‘what-if’ analysis.

A 10% drop in sales from your top customer may be crucial, whereas a small price increase from a supplier? Not so much. You need to understand these different scenarios — big and small — and how they can impact the future cash flow of your client’s business.

This is probably the most creative of reports covered here, as you’re making educated assumptions about what might / might not happen, when, and what the flow-on effects will be.

When you’re drawing up different ‘what ifs’ for comparison, make sure to detail the logic behind your assumptions and model them out. It’s a good exercise to compare the scenarios and the sensitivity of your assumptions.

Why is a cash flow projection helpful?

Cash flow is the most important business metric for several reasons, the first being liquidity — put simply, the ability to meet obligations from existing cash holdings. Failure to do so can have dire consequences for the business and those in control at a personal level.

Cash flow also impacts the business’ overall performance, measured by a profit and loss statement. In other words, are we earning more than we are incurring? This is not to be confused with is more cash coming in than going out. These concepts are related, but not the same.

Don’t forget: reports don’t have to be purely numerical. Not everyone is a numbers person and graphical reports can help tell a complicated story quite simply, especially when it comes to cash flow and profitability.

Remember your audience — most business owners aren’t financial experts, so make sure you tell the story in a language they understand.

Not only is reporting on transactions crucial for cash flow (no cash = no business), it’s also incredibly valuable to help your clients better understand how their business works, how to protect their future finances, and when to plan for growth.