Correlation between BAS & Cash Flow

When it comes to cash flow forecasting, one of the biggest causes of grief is the periodic BAS return. You know it comes around regularly, but far too often, businesses prepare the BAS and then wonder how they are going to pay for it in three- or four-weeks’ time, depending on whether you are a monthly or quarterly remitter.

Some businesses try and isolate funds for BAS into another bank account which is fine if your estimate is reasonably accurate and there’s no temptation to “raid the biscuit tin” in case of an emergency.

On the other side of the coin, if you’re a net exporter and purchasing mainly locally, you’ll often be in a BAS refund position. Now, you can wait until you’ve prepared your BAS to see what cash you’ll have. But surely a better situation would be knowing well in advance what cash is coming your way, so you decide how best to use it?

The difficulty in forecasting BAS obligations

Simply put, if you aren’t forecasting cash flow, you’ve got no chance of estimating your BAS obligations. You then run the risk of BAS shock and are scrambling to find funds to pay BAS, or to set up a payment plan with the ATO. If you keep repeating this process, also factoring in income tax instalments, it can get to the awkward stage of speaking to the ATO to negotiate a plan for larger debts. And there’s no fun in that.

How to avoid the BAS shock problem? Use CFM’s tax calendars.

How to do BAS using CashFlowMapper’s tax calendars

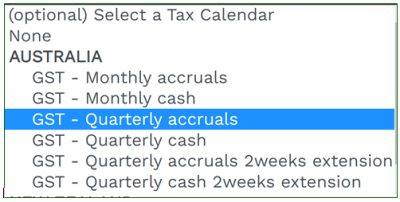

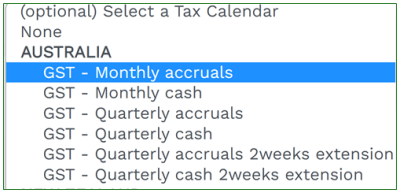

1. When you set up a plan, you select the tax calendar applicable to your business. Let’s assume we are submitting on a quarterly accrual basis.

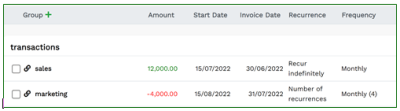

2. Let’s assume a very simple example with two transactions. The link symbol indicates they are subject to tax.

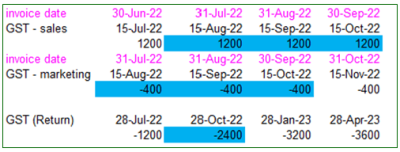

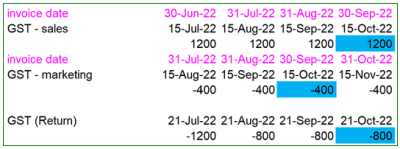

3. This extract of the occurrence dates report shows that the transactions with an invoice date occurring during the September quarter net out to a BAS remittance of $2,400 on the 28th of October.

It’s worth noting that all CFM reports – online and exported – will give you this information, and that tax on transactions pre-dating the start date of your plan that is to be remitted during the life of your plan is included in the GST (return) (BAS) line for reporting.

Also, the example above uses an accrual-based tax calendar and so the pink invoice dates (end of month) of the transactions determine which BAS period the tax on those transactions is remitted. If a cash-based tax calendar is selected, the relevant date is the date of the cash transaction (15th of the month for both transactions).

Ok, so what happens when the ATO requires your business to remit monthly when your GST turnover exceeds $20m? No problem. You simply select a new tax calendar, and CFM automatically updates GST (return) – your BAS.

1. Edit your plan and select the new tax calendar. There’s no change to the sales and marketing transactions shown above, only to when the GST on them is remitted.

2. This extract of the occurrence date report now shows GST on transactions with an invoice date occurring in September mapped to be remitted on the 21st of October.

3. And you’ll notice the total GST due from July to October is the same as that in the quarterly example:$3,600. CFM doesn’t miss a thing!

BAS shock avoided

You can see how CFM helps you avoid BAS shock. Going back to the introduction of this blog, where you are often in a refund position, you can see the benefits of knowing way in advance of the cash inflow of this transaction.

While this is an Australian example, CFM has tax calendars for other jurisdictions. It caters for multiple taxes applied to a single transaction (for example in Canada) and in one calendar you can have varying rates for a tax, which applies in India. So that’s consumption tax shock, anywhere, avoided!