What’s typically required to get grants or financing?

Financiers and government agencies rightly demand detailed and convincing information about your business when you are applying for financing or grants. The main components of the Business Plan are briefly discussed. We’ll then get to the role of cash flow forecasting in this process, and beyond.

Business Plan

This is an overarching document that outlines, among other things: the business, its vision, products and / or services, USP / points of differentiation, target markets, forecasted financials and a high-level strategy to achieve this. There will be subset plans supporting the business plan which will typically include the following. This list isn’t meant to be exhaustive.

- Competition analysis

The competitive environment is outlined, including a classic SWOT analysis which considers internal capabilities and external factors the business must utilize / deal with.

- Marketing strategy.

How the business has defined its target segments and the activities it will undertake to attract them. Without giving away business secrets, financiers will need confidence in firstly the business idea, and then the plans to achieve them.

- Operating Plans

Outline of how the business runs. Premises, assets, issues around people, industry-specific legislation and legal requirements, technology involved.

- Key personnel

This will detail the credentials of founders and key executives who will take the business forward. Financers need to have confidence in the people behind the business and the ideas it represents.

- Forecasted financial statements.

In simple terms, this is a measurement of the above factors, reflected in forecast profit & loss (performance), balance sheet (financial position), and cash flow (the movements in your bank account). These will typically be presented on a monthly basis and run 1 – 5 years, occasionally longer. In the context of an application for funding, this will also set out the level of funding needed and what the funding will be used for, be it starting up the business or expanding it.

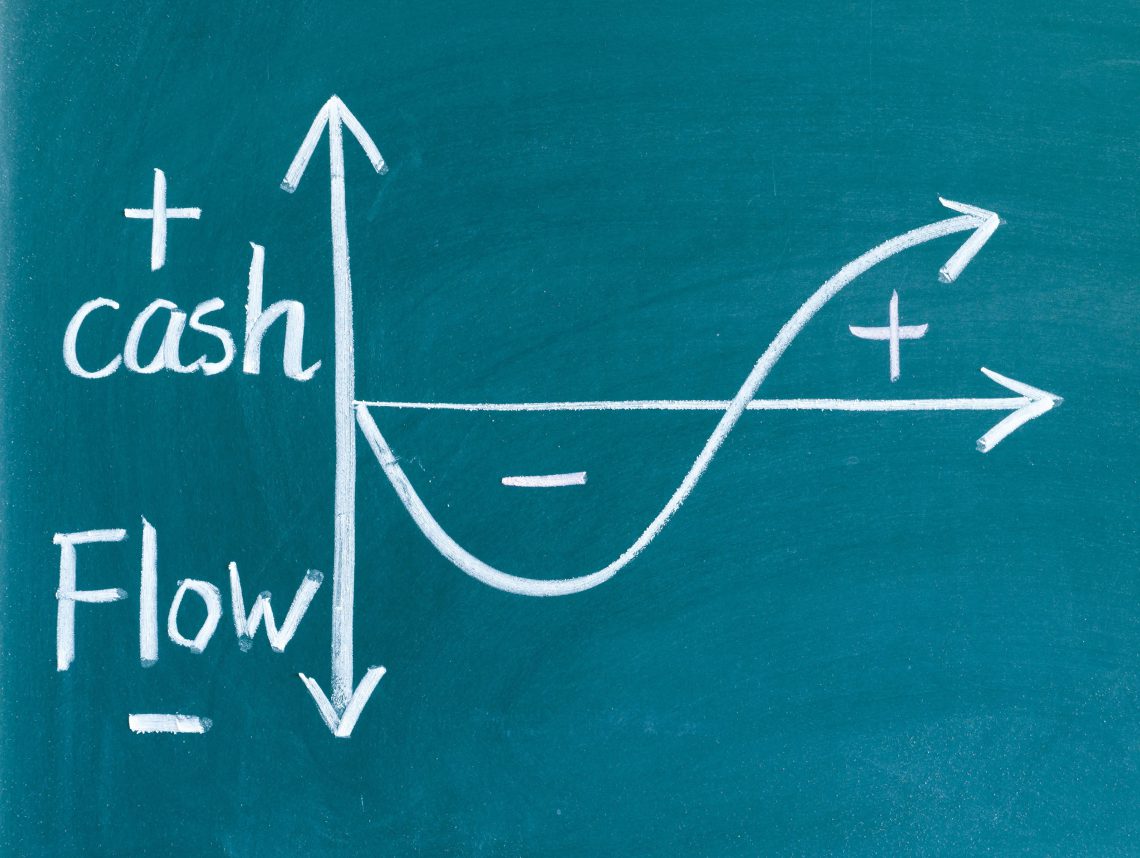

Why cash flow forecasting is the most important part of the business plan

A lot of work has gone into the business plan, and the result is that all involved have a clear idea of where the business wants to go and how they intend to get there. In fact, you can’t do this exercise properly just using high-level numbers. But strategy, like your business, can’t sit still.

Focusing on the cash flow forecast, there will be a lot more detail behind this model than that presented to potential financiers, and it is this level of detail that must be forecast constantly in order for you to stay in control of your business. Business plans need to be built up from the details in order for you to have confidence in the numbers you’re presenting. Below are a couple of the reasons why.

- Granularity.

Monthly figures are not enough detail upon which to forecast your business’ activity. Your month-to-month cash balances may look fine, but within the month, those positive ending balances may be dependent on the timing of inflows which in turn fund outflows. What if the timing of those inflows is altered and you all of a sudden can’t meet your obligations? It could be a temporary glitch and not be an issue, but what if it’s not? This is where scenarios are important.

- Scenarios.

Scenarios are just feasible alternative futures. The most common scenarios run are expected, best, and worst case scenarios. You need to have these forecasts so you can plan to deal with uncertainties such as losing customers, increased costs, targets not being met, delays in activities… and all the cash flow implications of these.

- What level of cash do we always want in our business? If we are forecasting to be in danger of breaching that level, then you can plan to do something about it. If we are forecast to vastly exceed that level, then you can plan what to do with that cash.

- How do changes in timing or frequency of transactions affect our forecast? Like the situation outlined under “Granularity”, you’ll need to understand the feasibility of timings in changes of cash flows – delayed customer receipts, renegotiations that may result in changes to both inflows and outflows, possible additional expenditure – and understand the cash flow implications of these.

- Armed with scenarios and the detail behind them, when your financiers almost inevitably ask for “more detail”, you’ll have it to hand. Showing them that you’ve gone to the effort of developing scenarios will give them confidence that firstly, you’ve considered numerous possible futures, and secondly, that you understand the impact of possible changes to your transactions. The only additional thing you’ll need to do is provide some explanation as to the reasons for your scenarios.

How CFM can measure your strategy and keep you in control into the future

CashFlowMapper is designed to easily deal with changes to your transactions (recurrences and frequencies) as well as making it easy to edit cash flow plans on a mass scale via the easy-to-use csv import facility. Scenarios are easy with CFM, as is comparing them via our graphical interface. This is a form of cash flow forecast that any audience can understand – even those that can’t think of anything worse than looking at a page of numbers.