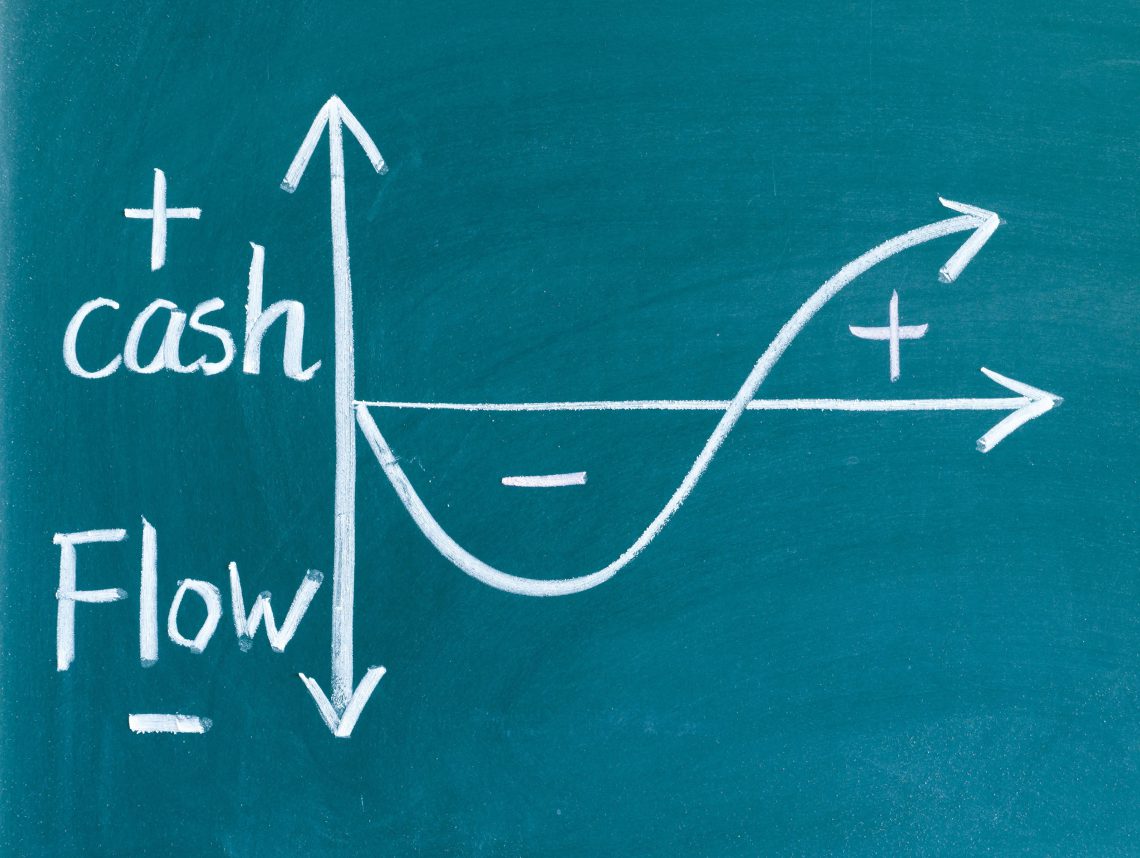

The traditional cash flow statement

-

Why it’s done.

This statement explains movements in your bank account between two dates and categorises these movements under the following headings.

- Operating. The net cash generated from day-to-day business. Cash revenue less cost of sales, expenses and taxes.

- Financing. Purchase and sales of long-term (life greater than 12 months) assets and investments.

- Investing. Inflows and outflows from debt and equity raising and repayment.

-

What purpose does it serve?

It’s a good tool to see how cash has been used in a business, and whether the uses of it make sense in the context of the business’ life cycle. For example, a start up business would expect to have a lot of financing funding inflows as it seeks to get to a point where it can begin to compete. Similarly, an established business that is successful should be able to show strong positive operating cash flows.

-

Is it useful for decision making?

By comparing to previous statements and to a forecasted version, trends in cash flow movement can be seen and you can determine if a business’ cash movements are on the right trajectory. The cash flow statement though is historically focused. It’s a good starting point, but not helpful as a forward looking planning and forecast tool.

The 3-way forecast

- Why do it?

The 3-way forecast ties together the 3 main accounting reports; balance sheet, profit and loss and cash flow statement. The three reports are all interlinked. These are typically done for between 12 months and five years and have monthly intervals.

- The profit and loss statement is built around assumptions on revenue and expenses, including depreciation and amortization as well as interest, both derived from asset and liability schedules. It’s period-end movements are reflected in the changes to retained earnings in the balance sheet.

- The balance sheet balances are influenced by working capital assumptions which drove the profit and loss, and the asset and liability schedules showing movements in these balances. Also factored in are debt and equity movements.

- Cash movement is derived from the cash movements in the profit and loss statement and in the balance sheet. The cash flow statement will simply explain the movements between opening and closing cash per the balance sheet for the forecasting period.

- What does it mean?

It’s a really good check to see if your data makes sense and your reporting model is robust. Everything will balance out, and a good model will easily accommodate scenario changes. This is especially important when presenting your data to seek financing or grants.

Is the 3-way forecast enough for cash flow forecasting?

The usefulness and deficiencies of the monthly 3-way forecast.

The 3-way forecast provides a good high-level overview of business activity, including cash flow, and as discussed above, ensures your data is rigorous in reflecting how transactions in your business flow through the three financial reports. However, from a daily cash management and planning perspective, the 3-way forecast is not enough, given that it at best shows movements on a monthly basis. It’s possible to build a model showing daily movements, but it would be very large and complicated, and there’s no value in seeing daily balance sheets and profit and loss statements. You can get a good enough picture by running these out of your accounting software.

The solution to cash flow forecasting needs of business

- Rolling forecasts

This is the most important and useful cash flow forecasting tool. By setting up and using this tool correctly, you won’t miss any important transactions, and you are warned when they are coming up.

- Daily balances

Cash flow forecasting models are best when daily balances are given. This is so the timing of transactions can be analysed and allowed for. If you have some payments with due dates which you must make, and you are reliant on receipts to make those payments, then it’s essential that the receipt dates are monitored in case they are late. Your model will tell you if you have to try and move payments in advance and can be proactive in these discussions, rather than you having to field angry calls about these after the due date.

- Comfort level of cash warnings

We all have a cash balance we feel we need to maintain at all times. Your forecasting model should show if you are going to breach this amount and therefore warn you in time to take corrective action, or alternatively, warn you in advance if you are going to exceed it by so much that you’ll have excess cash to plan to do something productive with.

- The discipline to keep your model updated

All the above is fine, but it needs your discipline to keep the model current and therefore relevant. This should be part of day-to-day business management just like monitoring sales and ensuring your people are engaged and happy in their roles.