Winning and retaining clients is all about relationships, and relationships are all about trust. Build trust and they will come — and stay! Whether you’re just starting out or want to grow your portfolio, we’ve got advice for all the advisors out there who want to build a long-term, loyal base of clients.

Tip 1: Understand where your client is going

Understanding where your client is now, where they’ve come from, and where they’re (ideally) heading with their business, sets the tone for what guidance you can provide.

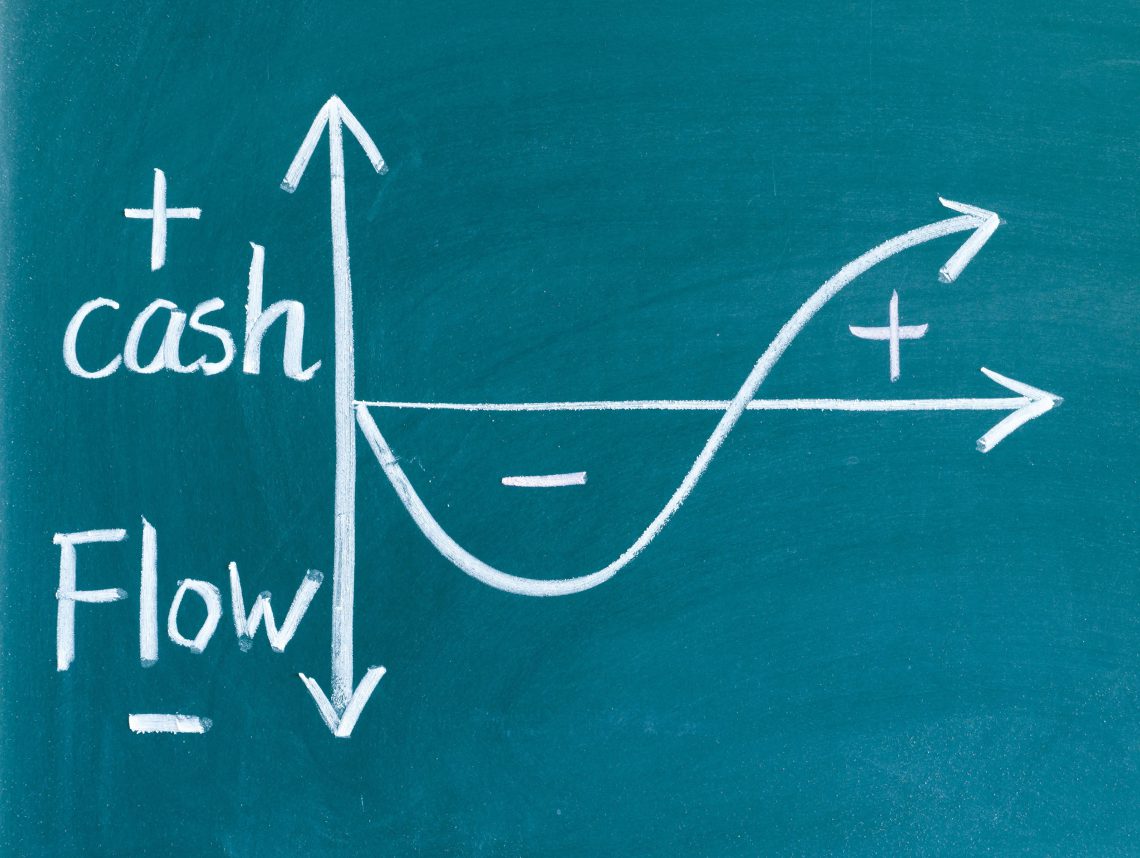

Your client’s motivations and goals will depend on the lifecycle stage of their business. For example, a start-up business will be looking to establish revenue sources before expanding, which may include taking on debt or equity to finance their growth.

On the other hand, a business owner looking to retire or hand their business on to a successor will be looking at securing the stability of contracts and revenue sources, and maybe eliminating or any reducing debt.

If there’s change afoot in your client’s industry (e.g. a strong new competitor enters the market), they may need to engage in defensive actions to maintain their current revenue streams and client retention, like offering more favourable terms such as discounts, extended payment terms, or add-ons at no extra cost. Your client’s business may have to develop more product or service offerings as well; standing still never works.

Tip 2: Share your knowledge generously

A big risk in the advisory or consulting space is ‘giving away free advice’, which is used by clients (and possibly others) and gives you nothing back in return.

The other extreme of this scenario is drip-feeding information on an as-paid-for basis, dragging out the engagement, creating mistrust and damaging client relations.

The solution? Ensure the scope of your engagement is clear from the start, and be prepared to offer everything required in order to help your client within this agreed-upon framework.

This will naturally include sharing the knowledge you’ve accumulated over time; knowledge that has helped you become the advisor you are!

If you’re worried about freely divulging ideas or guidance you feel is unique to you, include a non-disclosure agreement in your contract.

This is a big lesson in how to build trust. Your client has engaged for your expertise and you need to share as much as possible to provide value. If your client isn’t learning from you, developing their own skills and understanding, you’re not truly succeeding in your role as a trusted advisor.

Tip 3: Empower your clients with advice, not answers

Building client relationships means you can grow your advisory business without necessarily taking on more clients. The key is knowing how to keep current clients engaged. By giving easy answers instead of taking clients on a journey to discovering solutions, you run the risk of a relationship drying up.

Although ‘the answer’ is ultimately what your clients need, the process of finding that answer gives context and detail that aids your clients’ understanding whilst also enhancing your own credibility.

By explaining why you’ve suggested this over that, your client is less likely to ask the same question in the future. As your clients learn new skills through this process, they may even take on some of the tasks you initially do for them.

Cash flow forecasting is a classic example of something that can seem intimidating and therefore is often ignored, but once the value becomes clear and clients are equipped with simple tools to do it effectively, all that can change.

Tip 4: Speak your clients’ language

All industries and professions have their own lingo and we often speak in code without realising it. This can cause confusion when dealing with people from different industries, regions, or levels of experience.

An example of this is the phrasing around expenses used to determine gross margin. This is usually ‘cost of sales/goods sold’ to most people, but in some industries (e.g. travel and insurance) it’s referred to as ‘cost of seat’.

So before you start going on about ‘cost of sales’, ask your client what they call it. Their terminology may make sense, or you may actually advise them to change their language to suit the broader industry.

Before you get down to business, make sure you’re speaking the same language and are on the same page.

Tip 5: Be proactive & creative with your advice

If you’re producing the same kind of work for varying clients, it seems easy to use the same templates and ‘rinse and repeat’ your solutions.

A common first task in any business advisory work is a financial health check, analysing financial statements and reporting on areas of strength and concern.

You’ll generally then discuss the analysis and its implications, drawing up a proposal for further work based on these areas of need. This is important and useful, but it shouldn’t be the only part of your first steps with your client.

Come armed with information on their industry and competitors. You’ll probably develop a comprehensive SWOT analysis with your client a little later anyway, but turning up with this kind of information (you can certainly provide your thoughts on the external Opportunities and Threats) on Day 1 shows initiative and may even highlight areas of focus that would take other, less proactive, advisors weeks or even months to uncover.

Being a trusted advisor means your clients know you always have their best interests at heart and they can rely on you for personalised solutions — not just stock-standard answers.

The tips outlined here are ideal for anyone who wants to know how to become a financial advisor with a difference. Follow them and you’ll become more than just a source of advice: you’ll be a teacher, helping your clients become better business people and handing them the keys to their own success.